Extra principal payment calculator auto

Use this free calculator to see how even small extra payments will save you years of payments and thousands of Dollars of additional interest cost. For a 100000 loan at 6 percent interest for 30 years the monthly payment is 59955.

Extra Payment Calculator Is It The Right Thing To Do

This breaks down to a payment of 500 towards interest and 9955 towards the principal.

. 200000 Loan Amount Leave the Months field blank 75 Interest Rate Compounded Monthly 1500 Payment. Use our extra payment calculator to determine how much more quickly you may be able to pay off your debt. Conforming fixed-rate estimated monthly payment and APR example.

Make payments weekly biweekly semimonthly monthly bimonthly quarterly or. The calculator uses Your Investment Rate-of-Return and calculates the future value of all the projected extra payments. Making extra payments early in the loan saves you much more money over the life of the loan as the extinguised principal is no longer accruing interest for the remainder of the loan.

Original loan balance Annual percentage rate 0 to 40 Initial term in months 30yrs360 1 to 360 Number of payments already made 0 to 999 Proposed additional monthly payment Calculate 5 Ways to Create a Budget That Works. Check our financing tips and find cars for sale that fit your budget. Assumptions Original loan balance Annual percentage rate Initial term in months Number of payments already made Proposed additional monthly payments Adding per month will pay off your loan 0.

Use this calculator to help estimate the potential time and interest savings. Use this calculator to determine 1 how extra payments can change the term of your loan or 2 how much additional you must pay each month if you want to reduce your loan term by a certain amount of time in months. Transfer funds in Digital Banking.

Results are based on the assumption that the original mortgage repayment period is 30 years. Enter your information into the early loan payoff calculator below. From a Robins Account.

Because of the relatively high interest rate you have been making monthly payments of 1500 which you intend to continue with the excess going to principal. Interest Rate - The percentage cost of the principal borrowed. A 20000 loan with a 60-month repayment term and 5 interest rate in the end youll be paying 22645the 2000 principal and then an additional 2645 in interest.

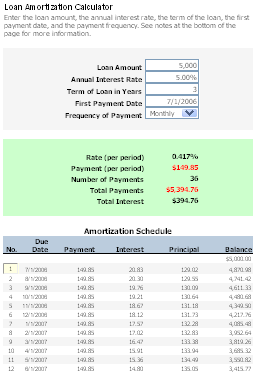

Auto Loan Amortization Calculator. Your required payments are 139843. Use this additional payment calculator to determine the payment or loan amount for different payment frequencies.

Original loan balance Annual percentage rate 0 to 40 Initial term in months 4yrs48 1 to 120 Number of payments already made 1 to 360 Proposed additional monthly payment Calculate. Click here to launch loan payment or call 833-886-6110 to pay over the phone using our Interactive Voice Response system. Principal Balance - The loan amount you borrowed.

Create amortization schedules for the new term and payments. Current monthly payment principal and interest only. It then calculates the investment gain and subtracts it from the Total Interest Saved to arrive at the net gain from the extra payments the Interest Saved Less Investment Gain shown.

Auto Loan Payoff Calculator Extra Payments Created with Sketch. The loan amortization calculator with extra payments gives borrowers 5 options to calculate how much they can save with extra payments the biweekly payment option one time lump sum payment extra payments every month quarter or year. Let our easy-to-use Auto Loan Payoff Calculator become your new best friend.

Enter your loan details into the auto payoff calculator to estimate how much of a difference it could make for you. An early payoff means a quicker route to full vehicle ownership and no more car payments. Try different loan scenarios for affordability or payoff.

Lets look at an example. Frequently the recommended method suggests making an extra payment equal to the principal amount owed on each monthly bill. 62 rows This auto loan calculator has everything that you may need to calculate your payment with options for down payment trade in sales tax fees extra payments bi-weekly payments and a detailed auto amortization schedule about each payment.

Paying extra on your car loan each month could provide valuable savings on interest and shorten the term of your financing. From Another Financial Institution. A 225000 loan amount with a 30-year term at an interest rate of 3875 with a down payment of 20 would result in an estimated principal and interest monthly payment of 105804 over the full term of the loan with an Annual Percentage Rate APR of 3946.

The Bankrate Auto Loan Early Payoff Calculator will help you create the best strategy to shorten the term of your car loan.

Free Loan Amortization Calculator For Car And Mortgage

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

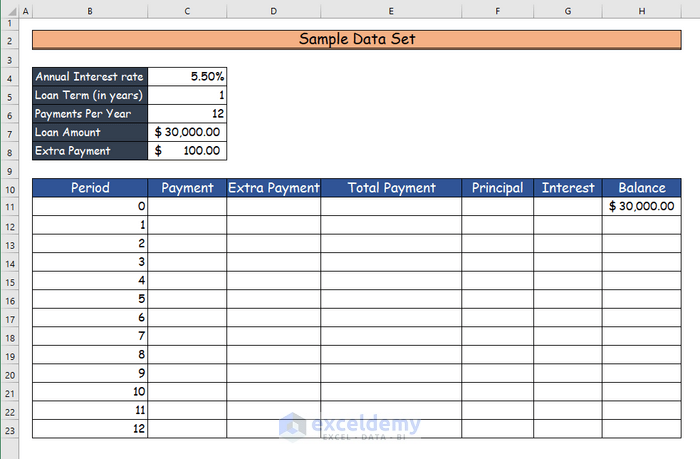

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Auto Loan Calculator Free Auto Loan Payment Calculator For Excel

Extra Payment Calculator Is It The Right Thing To Do

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

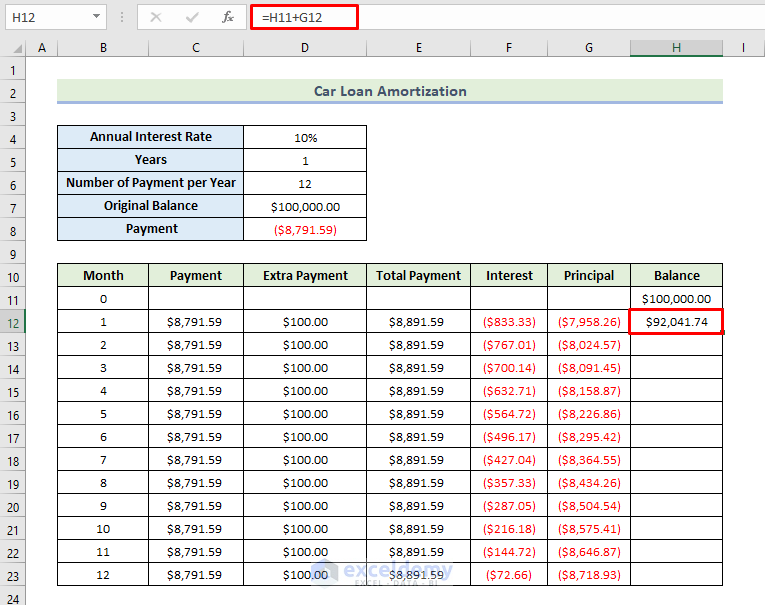

Car Loan Amortization Schedule In Excel With Extra Payments

Excel Loan Calculator With Extra Payments 2 Examples Exceldemy

Extra Payment Mortgage Calculator For Excel

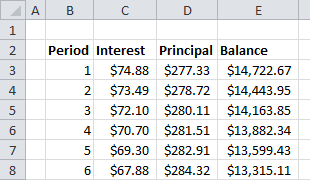

Loan Amortization With Extra Principal Payments Using Microsoft Excel Tvmcalcs Com

Loan Amortization With Extra Principal Payments Using Microsoft Excel Tvmcalcs Com

Create A Car Loan Calculator In Excel Using The Sumif Function Part 2

Loan Repayment Calculator

Download Microsoft Excel Mortgage Calculator Spreadsheet Xlsx Excel Loan Amortizatio In 2022 Mortgage Amortization Calculator Amortization Schedule Amortization Chart

Extra Payment Calculator Is It The Right Thing To Do